Company Registration

PAN & TAN Applications, 100% Online

Get your Permanent Account Number (PAN) and Tax Deduction Account Number (TAN) issued digitally—fast, paperless and fully guided by our experts.

(5k+ Positive Reviews)

1500+

HAPPY CLIENTS

8+ GLOBAL

AWARD ACHIEVED

Why PAN & TAN Matter

- Mandatory for Tax Compliance: You cannot file ITR, TDS returns or open a business bank account without PAN/TAN.

- Seamless Banking & Investments: PAN is required for high‑value transactions, mutual funds, property dealings and more.

- TDS Deduction & Reporting: TAN ensures correct tax deduction at source by your organization.

- Penalty Avoidance: Late or incorrect PAN/TAN applications can attract fines—get it right first time.

Our End-to-End Service

Form Selection & Guidance: We determine whether you need PAN only, TAN only, or both.

Document Checklist & Verification: We collect proof of identity, address and entity status (individual, HUF, company, etc.).

Application Preparation & Filing: Our team completes Form 49A/49AA (PAN) and Form 49B (TAN) and submits to NSDL/UTIITSL.

Follow‑Up & Dispatch: We track your application through to grant and deliver your e‑PAN card and e‑TAN certificate via email and courier.

Simple 3-Step Company Registration

What You Do

Provide your proposed company name, director details and registered office address

What We Do

Assess your requirements, advise on structure & prepare incorporation documents

What You Do

Upload director KYC (PAN, Aadhaar), proof of office address & DSC applications

What We Do

Obtain DSC/DIN, draft MOA/AOA and file all forms on the MCA portal

What You Do

Download your digital Certificate of Incorporation

What We Do

Send your incorporation kit and guide you on post‑incorporation compliances

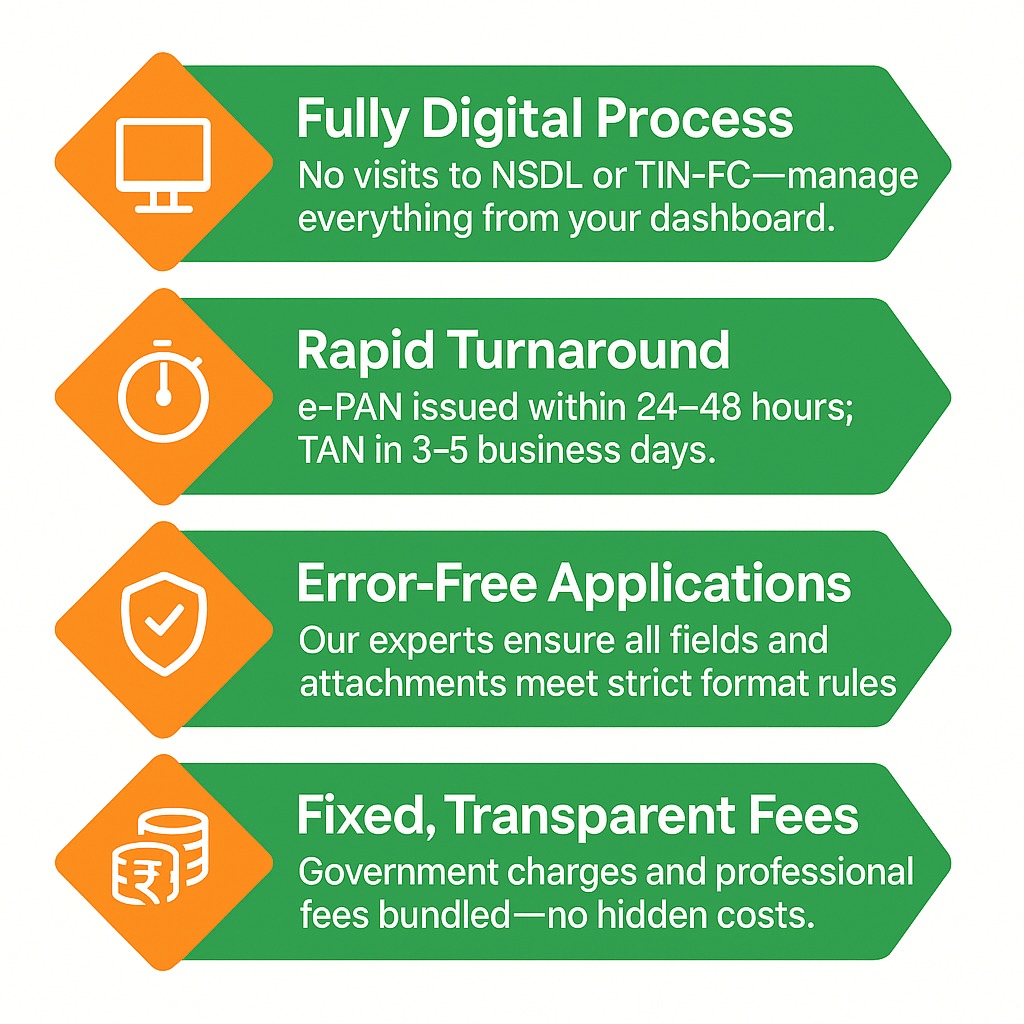

Key Benefits

Fully Digital Process: No visits to NSDL or TIN‑FC—manage everything from your dashboard.

Rapid Turnaround: e‑PAN issued within 24–48 hours of approval; TAN in 3–5 business days.

Error‑Free Applications: Our experts ensure all fields and attachments meet strict format rules.

Fixed, Transparent Fees: Government charges and professional fees bundled—no hidden costs.