Negotiable Instruments Act

Schedule a Free 15-Minute Consultation

Recover overdue debts efficiently—file applications, attend hearings and enforce awards with our experienced DRT advocates and support team.

(5k+ Positive Reviews)

1500+

HAPPY CLIENTS

8+ GLOBAL

AWARD ACHIEVED

Why DRT Matters

-

Statutory Forum: DRTs are the fastest, specialist tribunals for bank and financial‐institution debt recovery.

-

Speedy Relief: Typical recovery orders issue within 3–6 months versus years in regular courts.

-

Enforceable Awards: Tribunal orders can be executed like court decrees, attaching property and assets.

-

Cost‑Effective: Streamlined procedures and capped fees make DRT proceedings more affordable.

Our End-to-End Service

-

Case Assessment & Strategy: We review your claim, documentation and debtor profile to craft a recovery plan.

-

Application Drafting & Filing: Our legal team prepares Form DR (Application) and files with the appropriate DRT registry.

-

Hearing Representation: Senior advocates appear at every hearing, present evidence and argue for swift relief.

-

Order Execution Support: Once the tribunal issues its order, we initiate execution proceedings—attachment, sale and recovery.

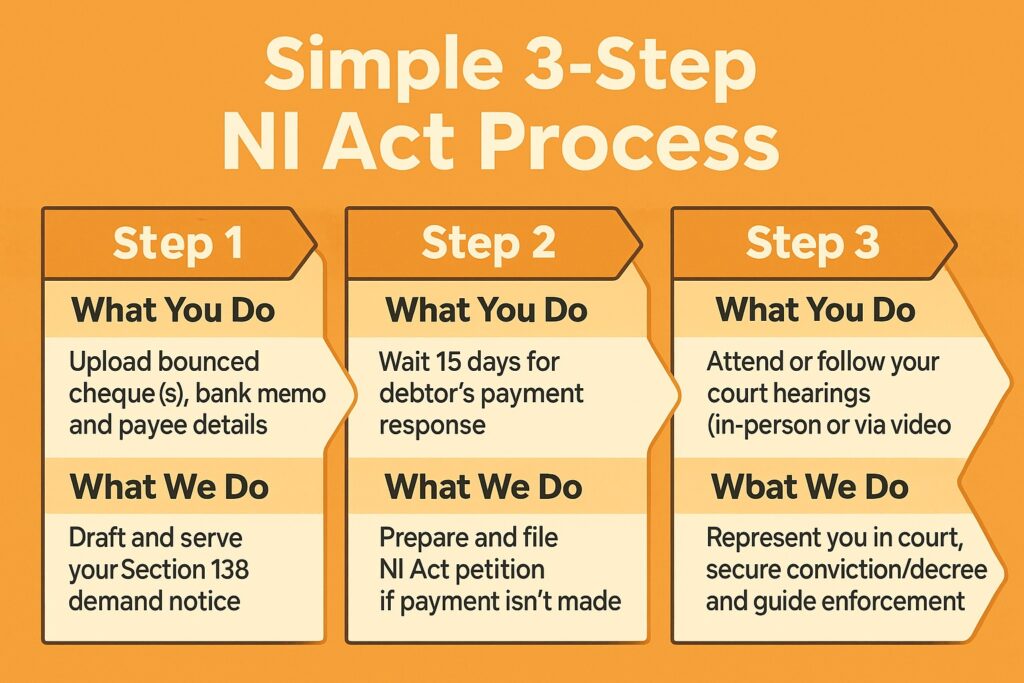

Simple 3-Step NI Act Process

What You Do

Upload bounced cheque(s), bank memo and payee details

What We Do

Draft and serve your Section 138 demand notice within 15 days

What You Do

Wait 15 days for debtor’s payment response

What We Do

Prepare and file the NI Act petition if payment isn’t made

What You Do

Attend or follow your court hearings (in-person or via video)

What We Do

Represent you in court, secure conviction/decree and guide enforcement

Key Benefits

- Speedy Proceedings: Most Section 138 cases resolve within 4–6 months.

- Fixed, Transparent Fees: All drafting, filing and appearance fees bundled—no hidden costs.

- Dedicated NI Act Advocates: Experts in cheque dishonor and recovery law.

- Real‑Time Case Tracking: Monitor notice dispatch, filing status and hearing dates online.